Domestic Reverse Charge Invoice Template - Back To Basics Vat Invoicing The Reverse Charge / For cis bills you receive, xero will

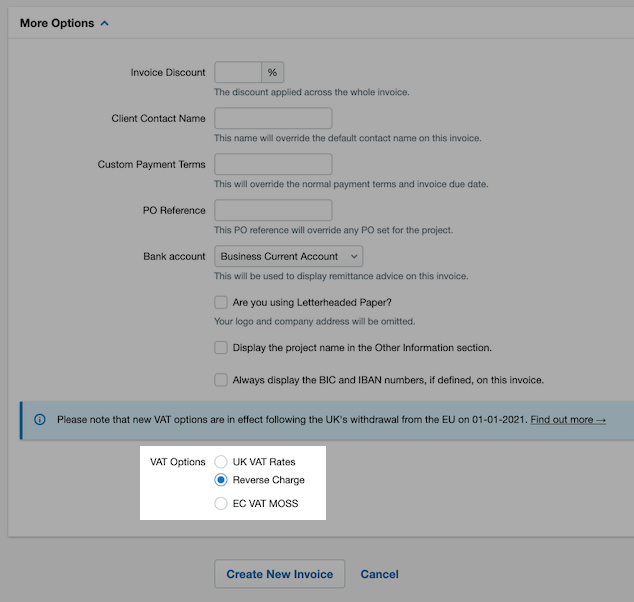

Domestic Reverse Charge Invoice Template - Back To Basics Vat Invoicing The Reverse Charge / For cis bills you receive, xero will. The customer and supplier conditions for this reverse charge to apply change depending on the goods traded. Overview 1.1 what this notice is about. With the vat domestic reverse charge, you might need to adjust the way you handle vat. Remember, you may need to change your template in clik service to put the drc charge in and clearly state it's a domestic reverse charge invoice. Xero will know that reverse charge is to be applied and will automatically ensure the correct vat boxes are updated on the vat return.

This makes your customers aware that the item falls under specific legislation for reverse charge vat. From march 1st 2021, the domestic reverse charge will apply for the majority of construction services. Currently, adding the reverse charges on a sales invoice is done manually. Once edited, new invoices will have the charge applied, with a note to make customers or suppliers aware. This means that the buyer will account for vat instead of the supplier.

Utilise reverse charge invoices and applications where appropriate.

It does not matter where you enter the reverse charge label, as long as it is clearly visible on the invoice. Mr contractor pays john the net £100,000 fee. All standard invoice and sales order layouts installed with sage 50 accounts display a warning message when a reverse charge tax code is used, for example t20. As the reverse charge work is 4.76% of the total invoice value (£500 / £10,500), you need to charge 20% vat on the whole invoice. Download training and guidance on reverse charge vat for construction businesses (pdf). Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0% vat rate, and a label stating: This service is then not taxable for the domestic company and no vat is shown on the reverse charge invoice. In short, you can exclude the vat from your invoices and forward the obligation of paying the correct vat to the customer. Looks like i will need to set up an excel template as my current invoicing software won't be able to cater for the reverse charge. Germany has introduced this optional reverse charge for domestic supplies of services and supplies of goods with installation. The customer and supplier conditions for this reverse charge to apply change depending on the goods traded. Choose from a wide variety of creative templates, personalise & send. ''the services invoiced, come under the domestic reverse charge and that the customer is required to account for vat, s55a vata 1994 applies will the next release of sage 50 accounts have a layout for this as you did with the commercial invoice layout in the 27.1 release?

A workaround is to use a recurring invoice template. To find out when reverse charge vat should be used, check out the govt website : You will only be able to apply these changes if the customer is vat registered in uk (i.e. Once you're happy with the invoice, you can post to sage. With the vat domestic reverse charge, you might need to adjust the way you handle vat.

Download training and guidance on reverse charge vat for construction businesses (pdf).

The domestic reverse charge to invoices from 1 march 2021. This video will show you how to edit your invoice templates to display the appropriate information for domestic reverse charge. Download a reverse charge vat template letter to customers (word). This means that the buyer will account for vat instead of the supplier. From march 2021, under the new cis reverse charge mechanism, he invoices £100,000. When was the vat reverse charge for construction services introduced? Entering a reverse charge vat invoice. Looks like i will need to set up an excel template as my current invoicing software won't be able to cater for the reverse charge. In short, you can exclude the vat from your invoices and forward the obligation of paying the correct vat to the customer. You will only be able to apply these changes if the customer is vat registered in uk (i.e. You will then see the option apply reverse charge vat.tick this option to include vat reverse charge on sales invoices raised for this customer. The vat domestic reverse charge for building and construction services affects the supply of certain kinds of construction services in the uk. With the vat domestic reverse charge, you might need to adjust your invoices to display the reverse charge.

With the vat domestic reverse charge, you might need to adjust your invoices to display the reverse charge. When was the vat reverse charge for construction services introduced? The domestic reverse charge to invoices from 1 march 2021. You might need to update your existing invoice templates that will require domestic reverse charge going forward. Domestic reverse charge may also apply on certain specific goods or services.

Currently, adding the reverse charges on a sales invoice is done manually.

Customer to account to hmrc for the reverse charge output tax on the vat exclusive price of items marked 'reverse charge' at the relevant vat rate as shown above. You will then see the option apply reverse charge vat.tick this option to include vat reverse charge on sales invoices raised for this customer. This can work perfectly if your client's transactions rarely change over time. This means that the buyer will account for vat instead of the supplier. If you've any specific questions about this, support will be able to you out in more detail than we can on community. ''the services invoiced, come under the domestic reverse charge and that the customer is required to account for vat, s55a vata 1994 applies will the next release of sage 50 accounts have a layout for this as you did with the commercial invoice layout in the 27.1 release? With the vat domestic reverse charge, you might need to adjust the way you handle vat. The reverse charge applies to the services supplied by the business (if those services are within the scope of cis) and vat should not be charged on the invoices. If you are a contractor you need to use the 'domestic reverse charge on expense' tax rates when entering bills for construction services and related supplies. Ensure your software is updated. All standard invoice and sales order layouts installed with sage 50 accounts display a warning message when a reverse charge tax code is used, for example t20. This makes your customers aware that the item falls under specific legislation for reverse charge vat. Create and send pdf invoices using 100 professional templates.

Komentar

Posting Komentar